Why Do Start-ups Fail to Scale?

Wendy Sayer, Content Manager at AccountsIQ looks at the key reasons why start-ups fail to scale.

For many entrepreneurs, setting up a business is the easy bit. It’s when your business scales that the growing pains really hurt. The harsh reality is that fewer than half of UK start-ups make the transition to successful scale-up.

In the start-up phase, many founders are so focussed on building and launching their product they don’t think about systems and processes. But, without those systems and processes you don’t own a business – you are the business. As you (and any co-founders) only have so many hours in a day, that severely limits your growth capacity.

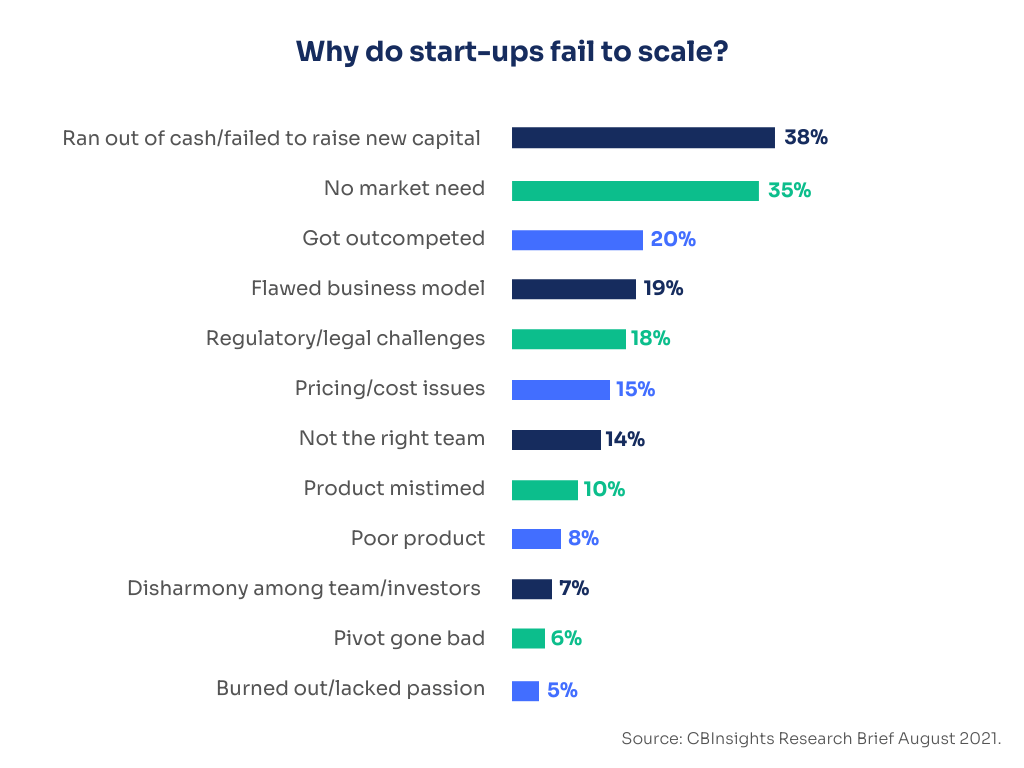

Here are the top 12 reasons that start-ups fail to scale, according to research from the CBI:

When you look at the list of reasons start-ups fail – running out of money, a flawed business model and pricing issues – it’s no surprise that the #1 system to get right is your finance system.

7 Finance Obstacles to Growing your Business

When bridging the gap from start-up to scale-up, founders typically experience similar pain-points with their finance systems and accounting processes. Here are seven of the most common ones:

- Difficulty fundraising: this can be a time-consuming, stressful process that distracts you from running and growing your business

- Outgrowing your start-up finance system: your starter accountancy software struggles to cope with your increased transaction volumes

- Lack of data: as your business grows and becomes more complex, you need real time insights broken down by product, revenue stream, region or other KPI to analyse performance and make fast, informed decisions

- Handling group accounts: if you create subsidiaries, you need to consolidate your group accounts every month

- Disjointed legacy systems and processes: you need your finance system to integrate and ensure automatic data transfers between your other business systems, such as your CRM, EPOS, payroll, expenses and bank

- Multi-currency and multi-company transactions: if you expand into new markets, you need effective FX and inter-company accounting

- Loss of control: when your team is geographically dispersed you need an effective audit trail to control and keep tabs on all financial transactions and reports.

You can alleviate many of these pain-points by getting on the appropriate finance system before it becomes an emergency. Your finance system should be designed to scale with you for at least the next 5-10 years.

The team over at AccountsIQ have put together a highly informative finance toolkit and guide for a growing business packed with real-world topics including:

- Why do start-ups fail to scale?

- Key success factors for high-growth companies

- What growth toolkit do scale-ups need?

- What will a Venture Capitalist (VC) expect to see in your finance operations?

- What’s my next step – do I really need an ERP system?

- How to use your finance toolkit to successfully execute your growth plan.

To find out more about the toolkit and guide click here

If you wanted to find out more on AccountsIQ, including their Financial Management Software package, click here to see how they could increase your business potential.

Don’t forget to check out our range on in-depth guides on key business topics in our always updated Guides resource page.